SP500 LDN TRADING UPDATE 29/10/25

SP500 LDN TRADING UPDATE 29/10/25

WEEKLY & DAILY LEVELS

***QUOTING ES1! FOR CASH US500 EQUIVALENT LEVELS, SUBTRACT POINT DIFFERENCE***

WEEKLY BULL BEAR ZONE 6830/40

WEEKLY RANGE RES 6939 SUP 6730

OCT EOM STRADDLE 6542/6951

NOV MOPEX 6951/6339

DEC QOPEX 6243/7085

DAILY STRUCTURE - ONE TIME FRAMING HIGHER - 6877

WEEKLY STRUCTURE - ONE TIME FRAMING HIGHER - 6690

MONTHLY STRUCTURE - ONE TIME FRAMING HIGHER - 6371

DAILY BULL BEAR ZONE 6910/00

DAILY RANGE RES 6985 SUP 6870

2 SIGMA RES 7043 SUP 6812

DAILY VWAP BULLISH 6856

VIX BULL BEAR ZONE 18.5

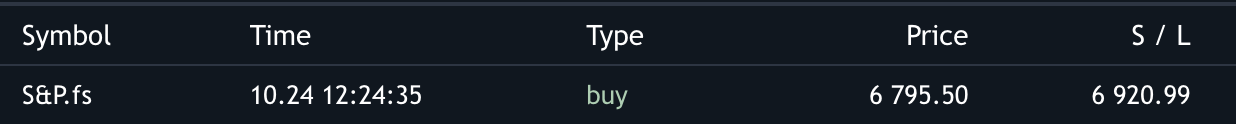

TRADES & TARGETS

LONG ON TEST/REJECT DAILY BULL BEAR ZONE TARGET 6951>DAILY RANGE RES

SHORT ON TEST/REJECT 6951 TARGET DAILY BULL BEAR ZONE

SHORT ON TEST/REJECT DAILY RANGE RES TARGET 6944

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE AT OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES COLOUR: AI EVERYTHING

S&P closed +23bps at 6,890, with a MOC sell imbalance of -$1.8b. NDX gained +74bps to 26,012, while R2K dropped -63bps to 2,504, and the Dow rose +34bps to 47,706. Trading volume reached 20.3b shares across all US equity exchanges, surpassing the YTD daily average of 17.3b shares. The VIX climbed +380bps to 16.39. WTI Crude fell -227bps to $59.92, US 10YR remained unchanged at 3.98%, gold declined -108bps to 3,976, the DXY slid -7bps to 98.71, and Bitcoin dropped -120bps to $113,123k.

The market exhibited a narrow breadth rally, with 398 S&P names declining despite the index’s rise. Earnings reports created mixed reactions, with shorts like PYPL and UPS squeezing higher while longs such as RCL and JBLU weighed on the travel sector. A significant headline of the day was the announcement of new AI and NVDA partnerships, adding to the week's top-heavy rally, as the NDX outperformed the R2K by ~275bps. Single-stock activity was less pronounced than the broader market moves suggested. Anticipation builds for tomorrow with BA and CAT earnings pre-open, the FOMC decision, GOOGL/META/MSFT earnings post-close, and the BOJ decision later in the evening.

Nuclear energy surged to the top of leaderboards following the US government's endorsement of large-scale builds, highlighted by an $80B pact with Westinghouse to construct nuclear reactors. Additional positive developments included a NEE/GOOGL collaboration to accelerate nuclear deployment in the US and FMRI’s agreement with Doosan.

Conversely, gaming stocks fell on reports that Trump Media plans to introduce prediction contracts on its Truth Social platform, allowing users to bet on events like political elections and inflation rates. Additionally, Polymarket is set to re-enter the US market with a sports focus, leading to a 3% drop in DKNG and FLUT. In consumer sectors, Staples underperformed after initial pops, continuing a recent trend (e.g., KDP -2% after yesterday’s gains).

Client net leverage remains low despite the market nearing all-time highs. This is evident in the shift in call skew (upside chasing) versus put skew (limited downside protection). Calls are in demand, while puts are being offered, marking the most aggressive SPX upside chase (1m 25dc) since the post-Trump victory rally in November 2024.

Activity levels on the trading floor were moderate, scoring a 5 on a 1-10 scale. The floor finished -160bps for sale versus a 30-day average of +27bps. LOs ended flat, while HFs were ~$800m net sellers, driven by macro tech trades.

After-hours movements included: BKNG +4.5% on earnings beat, STX +1% on strong results and slight guidance above expectations, CSGP +1% on solid beat and raised 4Q guidance, VRNS -28% after missing 3Q revenue estimates and ARR deceleration, VISA +1% on higher-than-expected net revenue guidance, BBIO +4% ahead of tomorrow’s ADH1 CALIBRATE study update, NBIX +2.5% on a 3Q beat with Cresnessity revenues at $98M (vs. $70M consensus), and BBNX +19% on strong results and raised 2025 guidance.

Key NVDA partnerships announced:

- NOK: NVIDIA to make $1.0B equity investment in Nokia.

- ORCL: NVIDIA and Oracle to build AI supercomputer for the US Energy Department.

- UBER: NVIDIA teams up with Uber to scale its mobility network.

- CRWD: CrowdStrike shares rose as much as 4.5% on NVIDIA partnership.

- BAH, CSCO, TMUS: NVIDIA collaborating with Booz Allen, Cisco, MITRE, ODC, and T-Mobile

OpenAI partnerships:

- MSFT: Microsoft signs a new pact with OpenAI.

- PYPL: PayPal and OpenAI team up to expand payments and commerce in ChatGPT.

Other AI and crypto developments:

- CRWV: CoreWeave surged on plans to enter the federal market.

- WU: Western Union to build a stablecoin on the Solana blockchain (WSJ report).

- ADBE: Adobe and Google Cloud expand their strategic partnership to advance creative AI.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!