Will Gold Prices Fall Further?

Gold Lower on Wednesday

Gold prices remain under pressure midweek following a heavy reversal lower yesterday. The recovery in USD and broader risk sentiment linked to softening US/China tensions has seen a heavy covering of long positions in gold futures. The squeeze has seen the market dropping around 8% in the last 24 hours. With USD poised to continue higher this week the correction lower in gold could have deeper to run.

US/China Talks

On the US/China front, there is optimism going into scheduled meetings between US and Chinese negotiators this week. The talks are aimed at delivering a deal ahead of the upcoming Nov 10th deadline for the current trade tariff suspension. At the very least, if an extension to the current tariff waiver can be agreed, this will be a positive for risk sentiment near-term and should see gold prices fall furtehr as risk assets and USD rally. Beyond these meetings, traders are waiting to see if Trump and Xi will meet at the APEC summit in Korea next week. If seen, this should furtehr boost expectations of a deal/extension being agreed.

Two-Way Risk

On the other hand, if talks stumble this week and tensions rise again, gold prices stand to quickly rebound higher as safe-haven demand soars. Given how volatile US/China relations are, there is a high risk that talks falter and if Trump and Xi don’t meet next week, this could be viewed as a signal that a deal or extension is unlikely to be agreed, weighing on risk markets and creating fresh safe-haven demand for gold. As such, incoming headlines around US/China talks will be a key near-term driver.

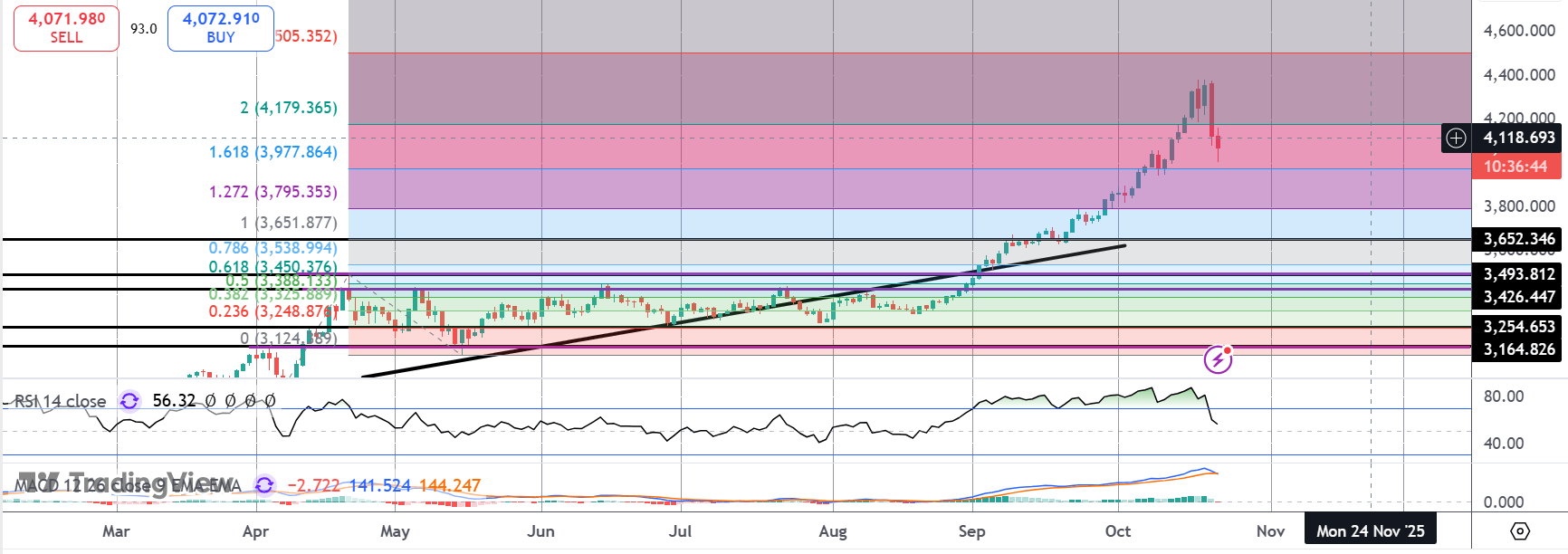

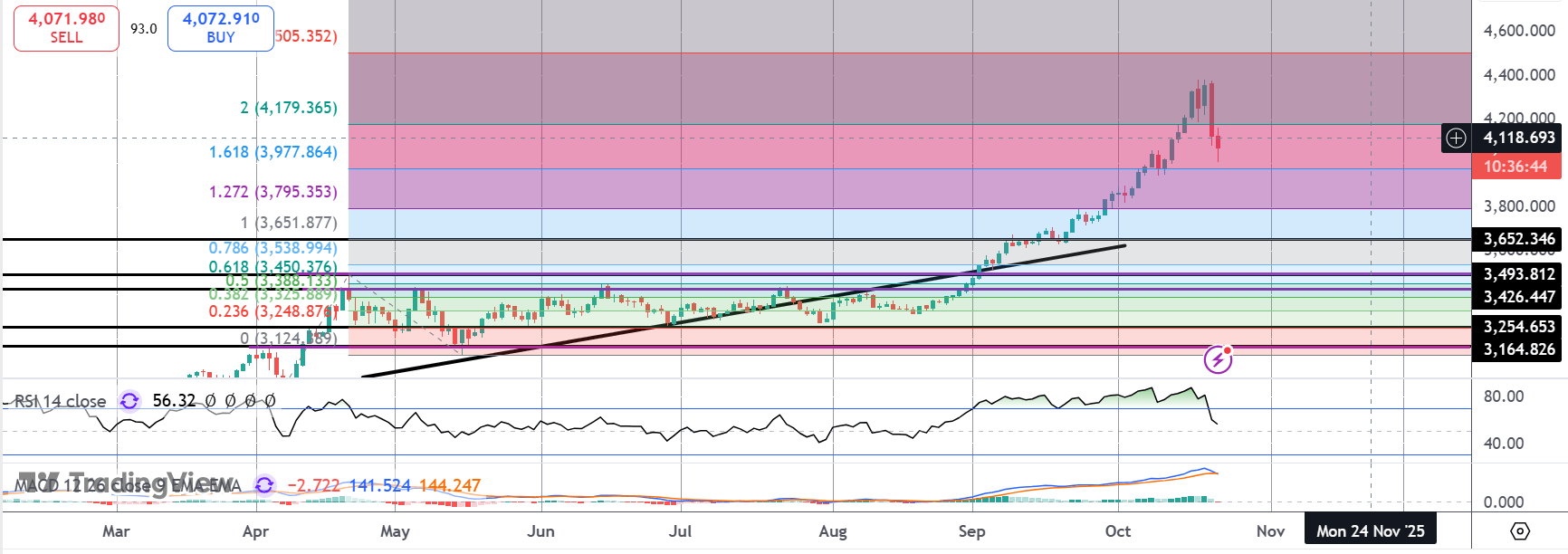

Technical Views

Gold

The sell of fin gold has seen the market falling back under the 2% Fib extension level and the 4,200 mark. While below here risks of a deeper correction are seen, in line with weakening momentum studies readings. The 161% Fib at 3977.86 will now be key support ahead of the deeper level at 3,795.35.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.