The FTSE Finish Line: June 26 - 2025

The FTSE Finish Line: June 26 - 2025

Patrick Munnelly, Partner: Market Strategy, Tickmill Group.

UK stocks edged higher on Thursday, with the midcap index climbing to a two-week high as investors digested a mix of corporate earnings and assessed the outlook for interest rates amid data showing a decline in consumer spending. Attention turned to Shell after the oil giant dismissed speculation about potential talks to acquire rival BP, with shares of both companies posting modest gains during the morning session.

Mining stocks led the day's sector gains, buoyed by rising mineral prices as a weaker dollar made commodities more attractive to investors using other currencies. Shares of Fresnillo, Antofagasta, Anglo American, and Endeavour Mining all advanced by over 2%. The midcap index has outperformed the FTSE 100 this quarter, positioning itself for its strongest quarterly growth since late 2020. Analysts note that companies focused on domestic markets have largely been insulated from trade-related uncertainties, while the UK remains one of the few nations with a trade agreement in place with the United States.

On the economic front, British retail sales declined this month, with industry expectations for July worsening, according to a survey by the Confederation of British Industry. Recent data points to a cooling economy, prompting traders to anticipate a 25 basis point rate cut by the Bank of England in September, based on LSEG projections.

Britain's FTSE250 midcap index has often been overlooked by investors, remaining 17% below its all-time high from late 2021. However, UBS strategists are now predicting a rebound in the coming months. They point out that British equities are trading at a discount compared to Europe, both in terms of price to earnings and price to book ratios, stating that "the FTSE 250, in particular, provides access to high-quality businesses at more attractive valuations than their larger counterparts." This downward trend has been ongoing since the Brexit vote in 2016, which caused the index to decline, and it has yet to fully recover, resulting in UK stocks being among the most affordable in developed markets. Additionally, UBS notes an improving macroeconomic environment, with a possibility of the Bank of England accelerating rate cuts, and they highlight that earnings forecasts for 2026 are optimistic. "Importantly, the FTSE 250 demonstrates significantly better earnings growth potential than the FTSE 100 or Europe," according to UBS. They advise investors to favour the FTSE 250 over the FTSE 100 and to increase their holdings in UK consumer stocks.

Single Stock Stories & Broker Updates:

Inchcape shares rise 5% to 715p, amid a 0.2% increase in the FTSE mid-cap index. The company maintains its FY outlook, crediting cost and inventory management for a resilient performance despite limited tariff impacts. Investors may be reassured by the unchanged guidance. The stock is down 7% year-to-date.

Shares of British consultancy Next 15 have dropped over 16% to 241p, marking the largest percentage decline since September 2024. The company anticipates that its FY26 profit will be "materially below" expectations, with revenue expected to meet projections. Analysts project FY26 revenue at 491.7 million pounds and profit at 51.9 pence per share, based on a company-compiled consensus. Following a possible serious misconduct disclosure, a lower conversion rate of opportunities within the Mach49 business is expected. Additionally, Sam Knights has been appointed as CEO after Tim Dyson's retirement. Year-to-date, the stock has fallen by 38.48%.

Moonpig's shares fell 7.6% to 225p, the largest drop since December 2024. The company anticipates FY26 adjusted earnings per share growth of 8-12%, down from 18.1% in 2025. CEO Nickyl Raithatha is departing. FY revenue was £350.1 million, below the expected £352.9 million. Year-to-date, the stock is up 6.4%.

Technical & Trade View

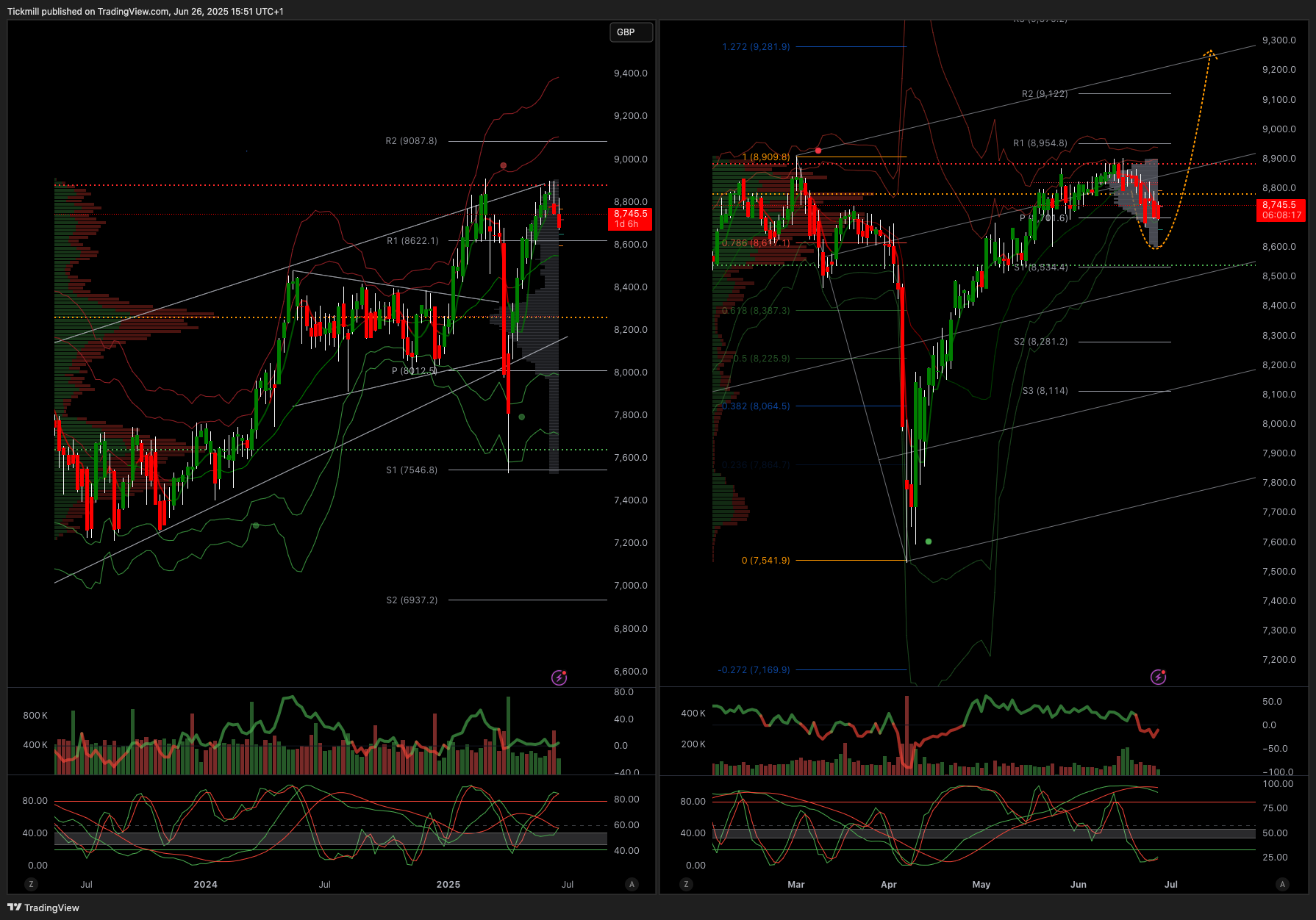

FTSE Bias: Bullish Above Bearish below 8700

Primary support 8600

Below 8500 opens 8400

Primary objective 9200

Daily VWAP Bearish

Weekly VWAP Bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!