Short and Medium-term Drivers of the USD Index you Should Know About

After the correction of the US equities in March, the movements of the US Dollar index and the SPX stock benchmark formed a noticeable relationship:

Quantitatively, this is also indicated by the trend in 100-day rolling correlation (of daily returns on DXY and SPX), which rose to a record negative value of -0.95:

Source: Bloomberg

The US Dollar index regained some lost ground thanks to the recent stock market pullback market correction, rising to the highest level since the end of July (94.70 level). Assuming that significant negative correlation will persist for some time, further rally in the dollar will require deeper sell-off in the stock market. One of the factors determining the relationship is inflation expectations. When stocks decline, they also fall, which pushes the real rate up fueling demand for USD:

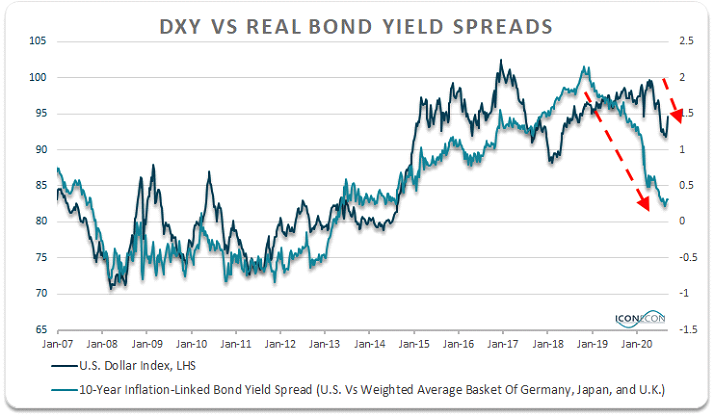

To be more precise, it is not just the path of the US real interest rate that matters, but its performance relative to real interest rates in other countries. That is, we should be interested in real yield differential. Spread between real interest rate in the US and weighted average real interest rate in Germany, the UK and Japan has fallen from 2% since the beginning of 2019 to 0.2-0.3% to date, however pullback of the Dollar index in this period was less profound:

In other words, USD has room to fall more to come in line with the "fair value” determined by the real rate differential, so a medium-term bet on the cheap dollar may be entirely justified. Corrections of the dollar upward, as you can see, mainly stem from the decline in the stock market, which with current Central bank policies promise to be short-lived.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 76% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.