RBA Governor Says Further Rate Cuts Likely

In his semi-annual testimony before Australian parliament yesterday, RBA governor Lowe told law-makers that he stands ready to reduce interest rates further if necessary. However, Lowe tempered his message saying that the Australian economy is likely through the worst of the slowdown.

Lowe's comments came as the bank released its quarterly statement on monetary policy in which it pushed back its projections for growth, inflation and employment based on current projections of two further cuts which would bring the cash rate down to 0.5% from the current record lows of 1%.

Economy At Gentle Turning Point

Lowe told the parliamentary panel “There are signs the economy may have reached a gentle turning point… Consistent with this, we are expecting the quarterly GDP growth outcomes to strengthen gradually after a run of disappointing numbers.”

Lowe went on to say “While we might wish it were otherwise, it is difficult to escape the fact that if global interest rates are low, they are going to be low here in Australia too,” Lowe said in his semi-annual testimony. “Our floating exchange rate gives us the ability to set our own interest rates from a cyclical perspective, but it does not insulate us from long-lasting shifts in global interest rates driven by saving/investment decisions around the world.” Offering further clarification, Lowe told the parliamentary panel "It's possible we end up at the zero [rate] lower bound. I think it's unlikely but it is possible,"

Lowe Defends Rate Cuts

The RBA held rates unchanged in August following two consecutive prior rate cuts in June and July. However, the market is currently pricing in two further rate cuts over the remainder of the year, in line with the RBA’s own guidance. Lowe defended the recent rate cuts, saying "If we didn't have the level of interest rates we have today — let's say they were 1 percentage point higher — I'm confident the exchange rate would be higher” which he explained "would be hurting our agricultural sector, our miners, our tourism sector, the education sector."

In the bank’s quarterly statement it said "The signs of stabilisation in the housing market reduce one possible source of downside risk to consumption growth and could provide some upside risk towards the end of the forecast horizon,"

Growth Forecasts Cut

In terms of growth, the RBA revised its forecast on GDP for 2019 lower from 2.75% to 2.5%, as well and also outlined a more subdued outlook on inflation through 2020.

The bank went on to say "Uncertainty is clouding how much any increase in labour demand will be met by unemployed workers finding jobs, existing employees working more hours or a further increase in the participation rate,"

However, despite the downside risks, the RBA noted that reductions in the cash rate as well as reduction federal government tax, should help boost growth in household consumption over the medium term, with a pickup in the property market also expected to contribute.

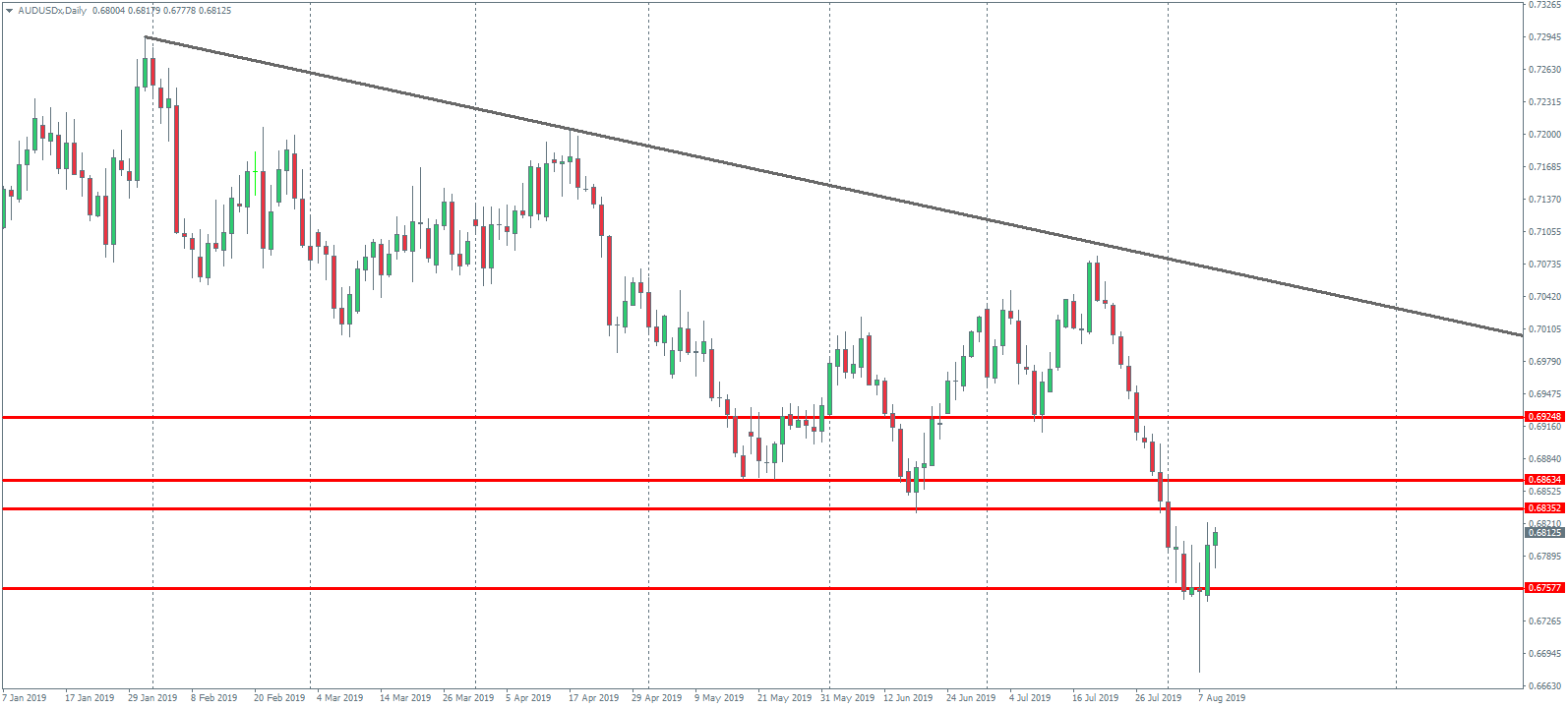

Technical Perspective

AUDUSD tested the .6757 level this week, piercing below the level to trade fresh 2019 lows around .6676 before reversing strongly and closing back above the level. The bullish pin bar at lows, creating a potential double bottom, suggests the likelihood of a further recovery higher. However, there is plenty of resistance in the near vicinity with the .6835 - .6863 zone sitting just above market. Above there we have the mid July .6924 level. Until price is firmly back above these levels the risk of further losses remains high in the near term.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.