Daily Market Outlook, July 9, 2024

Munnelly’s Macro Minute…

“FED Chair Powell Testimony The Macro Catalyst For The Day”

Japanese stocks, particularly semiconductor-related shares, led gains in Asia following their US counterparts. The Nikkei 225 Stock Average set a new record, with a year-to-date gain of over 23%. Australian equity indices and US stock futures surged, while the S&P 500 closed 0.1% higher on Monday. Mainland China and Hong Kong saw a decline in shares as the dollar strengthened against other major currencies. Information technology shares were the largest contributors to gains in the MSCI Asia Pacific Index, with sentiment around stocks with high exposure to AI being the most elevated since 2019. In China, markets are skeptical about the central bank's fresh liquidity operations announced on Monday, and investors are also looking ahead to a major annual policy summit next week. The Bank of Japan is set to have key meetings aimed at gauging a realistic pace for a reduction of its bond purchases to be announced later this month, with increased demand at a Japanese five-year auction despite speculation about the BOJ's bond buying reduction.

Today, Washington is taking center stage, with intense post-French-election negotiations underway. Federal Reserve Chair Jay Powell will begin two days of semi-annual Congressional testimony with an appearance before the Senate on Tuesday. While inflation was a concern earlier this year, it has since cooled, and the job market is showing signs of strain from months of tight policy. Traders will be closely monitoring Powell's balancing act between addressing price pressures and avoiding unnecessary hardship for American workers. Following Powell's testimony, Thursday will bring the latest consumer price data, which may not be the preferred sequence of events for investors and Powell. There are also uncertainties surrounding the U.S. presidential election in November, with Joe Biden facing pressure to retire despite his insistence on staying in the race. Biden's odds of running have increased, while odds on Kamala Harris replacing him have fallen. Meanwhile, Donald Trump may announce his running mate on July 15 at the start of the Republican convention. In France, the political landscape is uncertain following a split vote across three parties, with the leftist New Popular Front emerging as the winner and President Emmanuel Macron's centrist Ensemble Alliance securing seats in parliament. This outcome is likely to result in a period of political paralysis and a decrease in France's influence in Europe.

Overnight Newswire Updates of Note

NATO Summit Puts Biden’s Fitness Under a Microscope - WSJ

Hamas Chief: Latest Israeli Attack On Gaza Endangers Ceasefire Talks

Fitch: US, China Challenges Persist For Global Credit Outlook

BoJ Sounds Out Market Players Before Finalising Bond-Buying Cuts

Britain’s Retailers Report Sharp Drop In Spending In Colder June

Australia Business Conditions Worsen In June, Job Outlook Dims - Yahoo

Japan’s Nikkei Hits Record High as Chip-Related Shares Track US Peers

APAC Stocks Rise Before Powell’s Testimony: Markets Wrap

S&P 500, Nasdaq Hit New Records As US Stocks Start Week With Gains

Roche Receives CE Mark For Continuous Glucose Monitoring Solution

Saudi Aramco Mandates Banks For Multi-Tranche USD Notes

Shell Redeploys Gulf Of Mexico Staff To Its Perdido, Whale Oil Platforms

Oil Prices Continue Retreat On Tuesday, Extending Losses

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0700 (2.1BLN), 1.0710-20 (1.5BLN), 1.0725 (379M), 1.0750 (1BLN)

1.0765-70 (1BLN), 1.0780 (404M), 1.0800 (2.9BLN), 1.0815-25 (813M),

GBP/USD: 1.2605 (533M), 1.2645-60 (689M), 1.2770 (404M)

AUD/USD: 0.6665 (780M), 0.6700 (438M), 0.6750-60 (1.7BLN)

NZD/USD: 0.6250 (436M)

USD/CAD: 1.3660-70 (889M), 1.3685-90 (962M), 1.3700 (262M)

USD/JPY: 160.00 (587M), 161.00 (450M)

CFTC Data As Of 5/7/24

JPY: -184,223 contracts

EUR: -9,519 contracts

GBP: 62,041 contracts

CHF: -43,443 contracts

Bitcoin: -912 contracts

Equity fund managers cut S&P 500 CME net long position by 24,005 contracts to 953,130

Equity fund speculators trim S&P 500 CME net short position by 5,025 contracts to 293,675

Technical & Trade Views

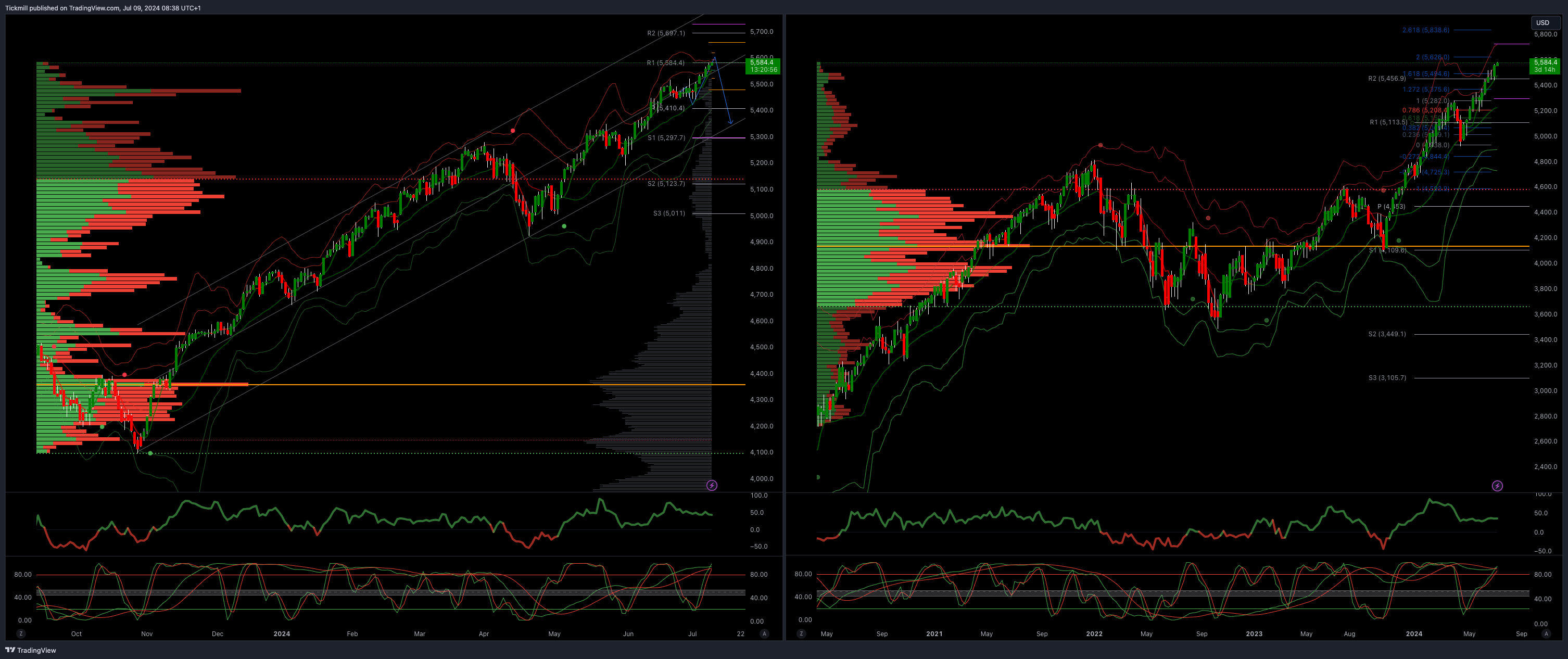

SP500 Bullish Above Bearish Below 5480

Daily VWAP bullish

Weekly VWAP bullish

Below 5475 opens 5450

Primary support 5370

Primary objective is 5580 - TARGET HIT NEW PATTERN EMERGING

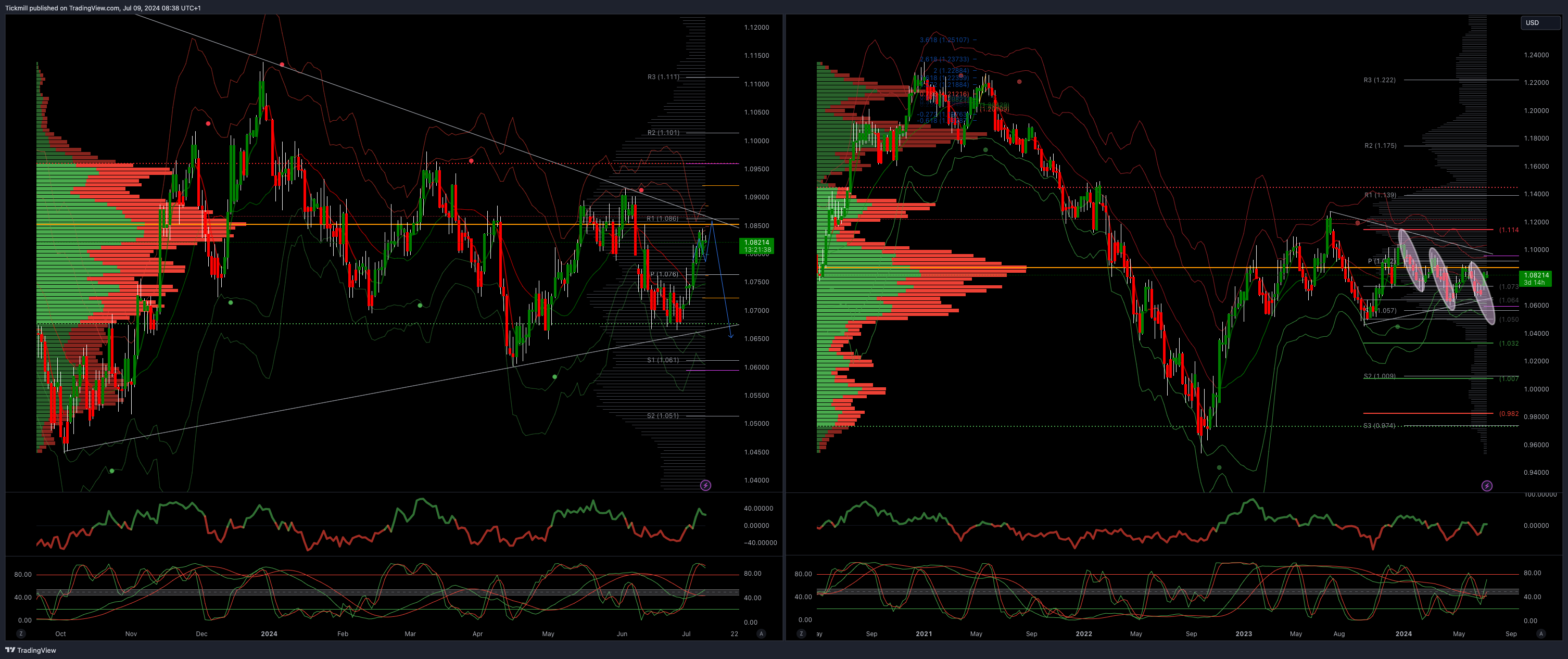

EURUSD Bullish Above Bearish Below 1.0750

Daily VWAP bullish

Weekly VWAP bearish

Above 1.880 opens 1.0940

Primary resistance 1.0981

Primary objective is 1.0650

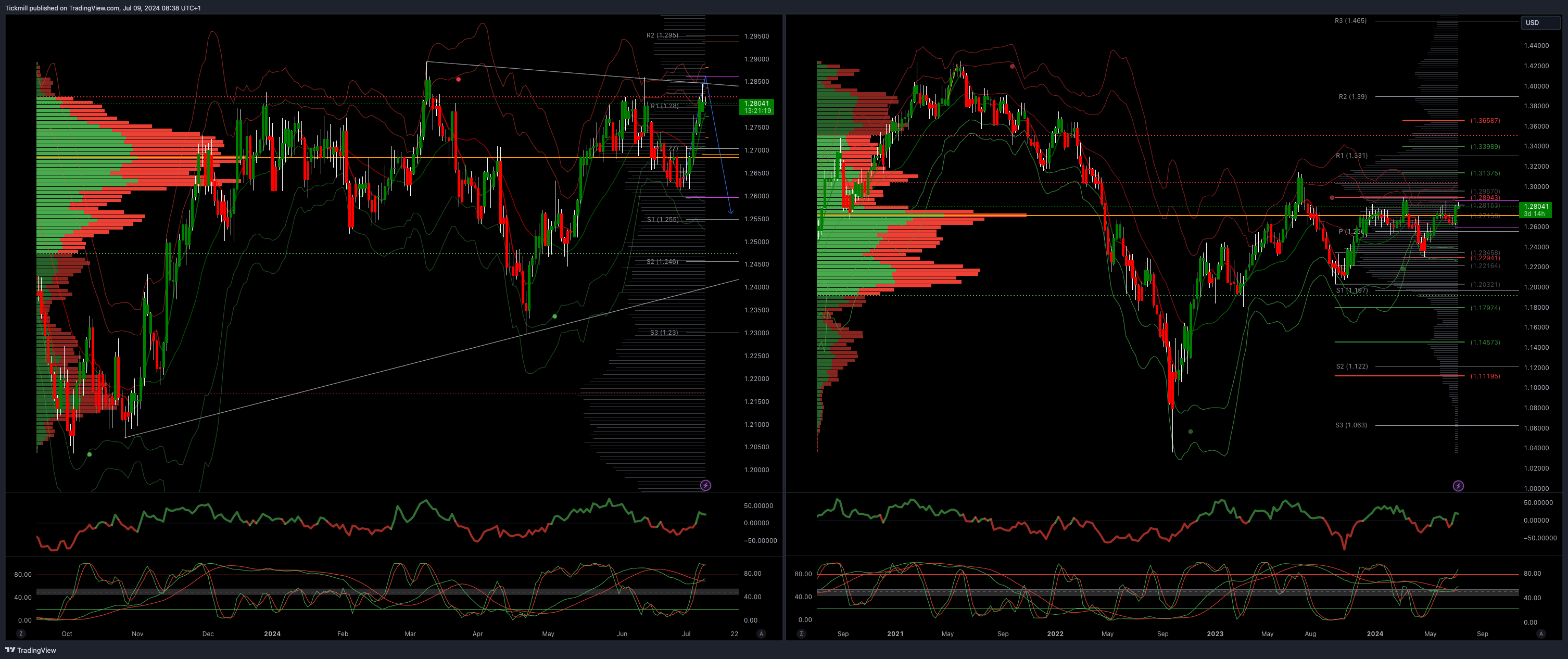

GBPUSD Bullish Above Bearish Below 1.27

Daily VWAP bullish

Weekly VWAP bearish

Above 1.29 opens 1.3130

Primary resistance is 1.2890

Primary objective 1.2570

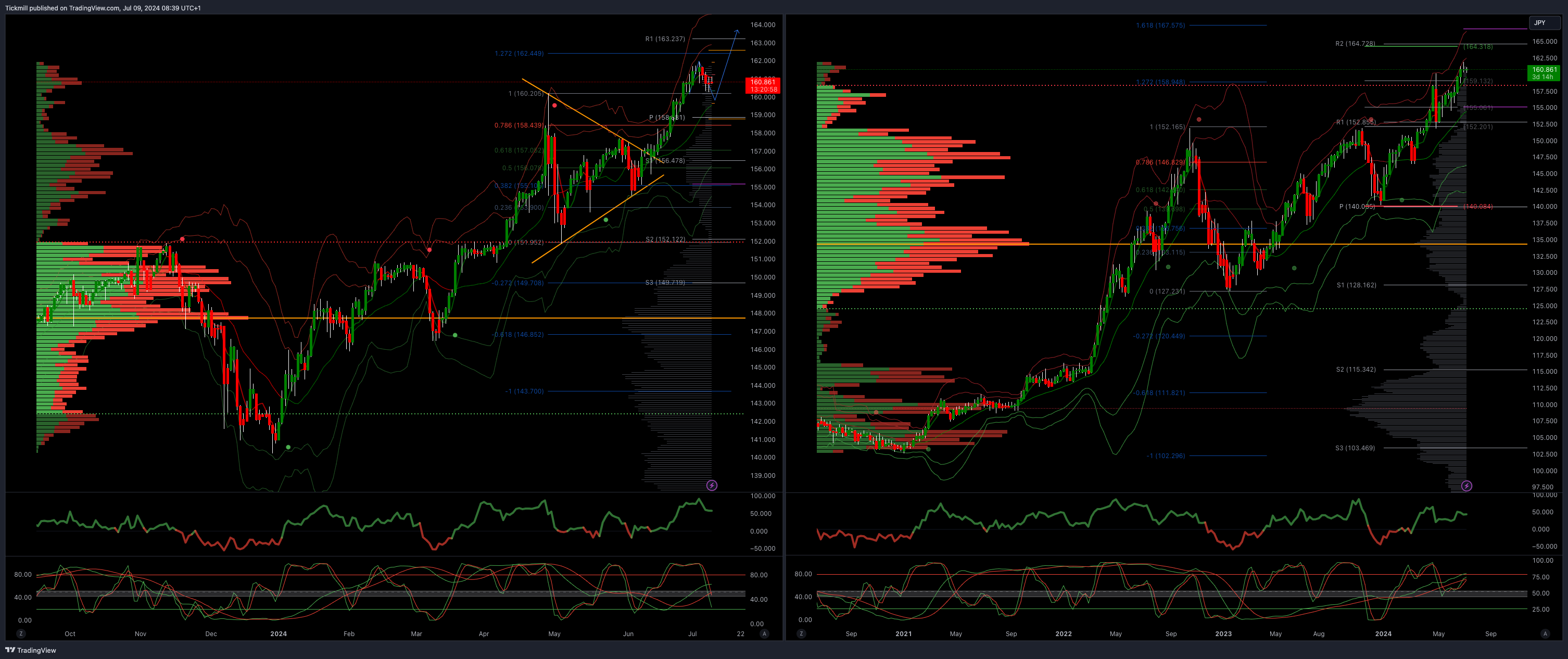

USDJPY Bullish Above Bearish Below 160

Daily VWAP bullish

Weekly VWAP bullish

Below 157.60 opens 157.10

Primary support 152

Primary objective is 164

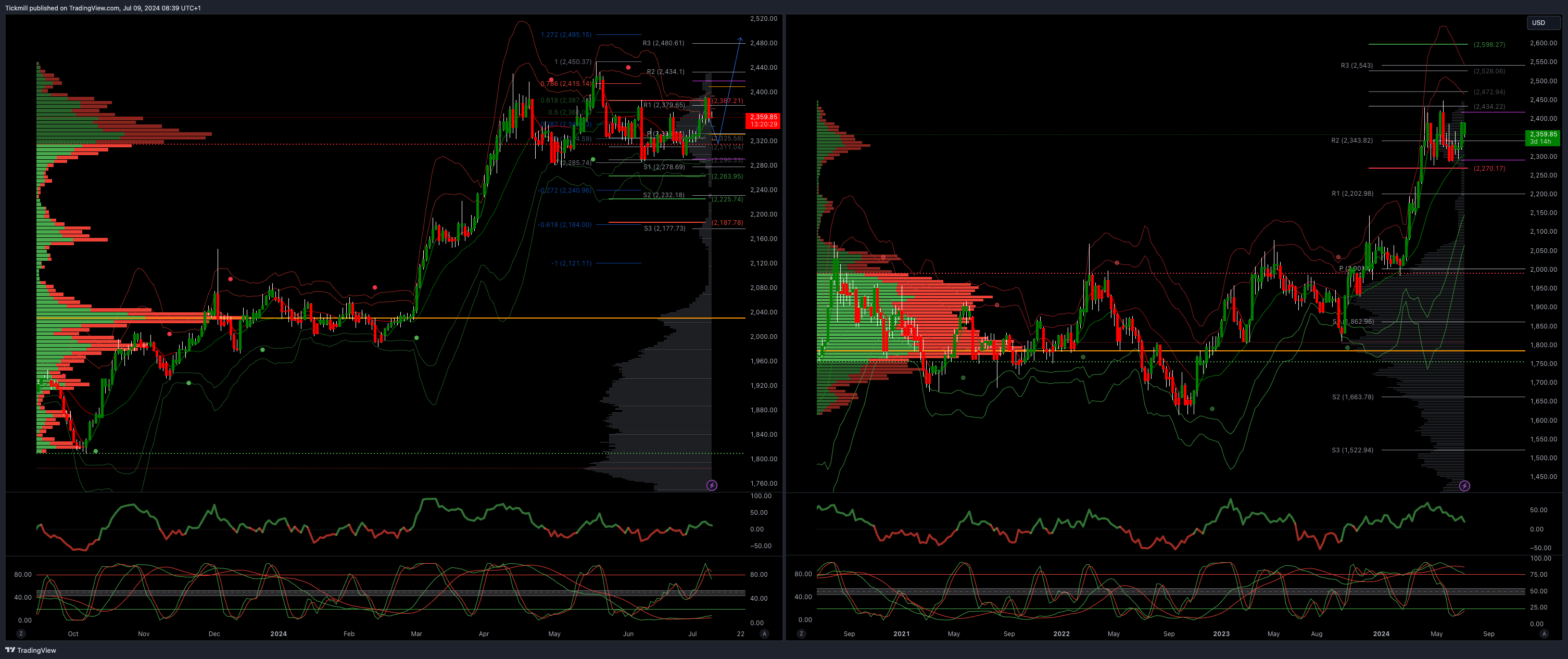

XAUUSD Bullish Above Bearish Below 2345

Daily VWAP bullish

Weekly VWAP bullish

Above 2415 opens 2495

Primary resistance 2387

Primary objective is 2262

BTCUSD Bullish Above Bearish below 60000

Daily VWAP bearish

Weekly VWAP bearish

Above 67000 opens 70000

Primary support is 50000

Primary objective is 54500 - TARGET ACHIEVED NEW PATTERN EMERGING

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!