Copper Falls As Trade Fears Return

Firmer USD Hurts Copper

Following a strong upside move on Wednesday, copper prices are falling back ahead of the weekend with the futures market now down around 2% from the week’s highs. Price had spiked mid-week as the US ADP print came in well below forecasts, raising speculation of a soft NFP print to come. Market chatter around a potential Fed rate cut this month was helping underpin risk sentiment. However, an eventual upside beat in the NFP yesterday put an end to this speculation with copper prices seen reversing lower as USD rebounded. Traders have now fully undone July easing expectations which could pave the way for a firmer USD over the next week, creating further headwinds for copper prices.

US/China Trade Uncertainty

Copper is also being hit this week by rising uncertainty ahead of the end of the US/China 90-day tariff window next week. Tariffs are set to rise back to prior levels on July 9th unless a deal or an extension is agreed. Given China’s status as the largest importer of copper, the prospect of a return to higher tariffs is a big threat to the demand outlook. Indeed, recent data weakness shows that the Chinese economy is already struggling and could fare worse under renewed tariffs. If tariffs are resumed copper prices look set to pullback further near-term.

Technical Views

Copper

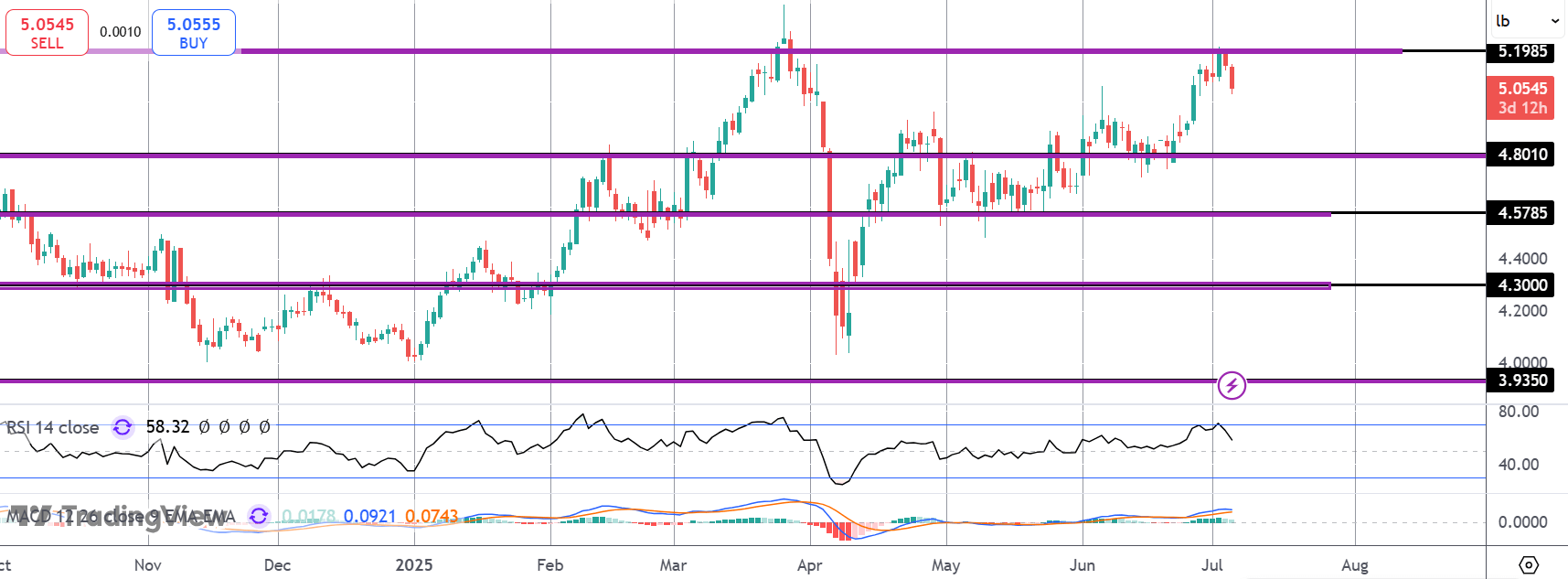

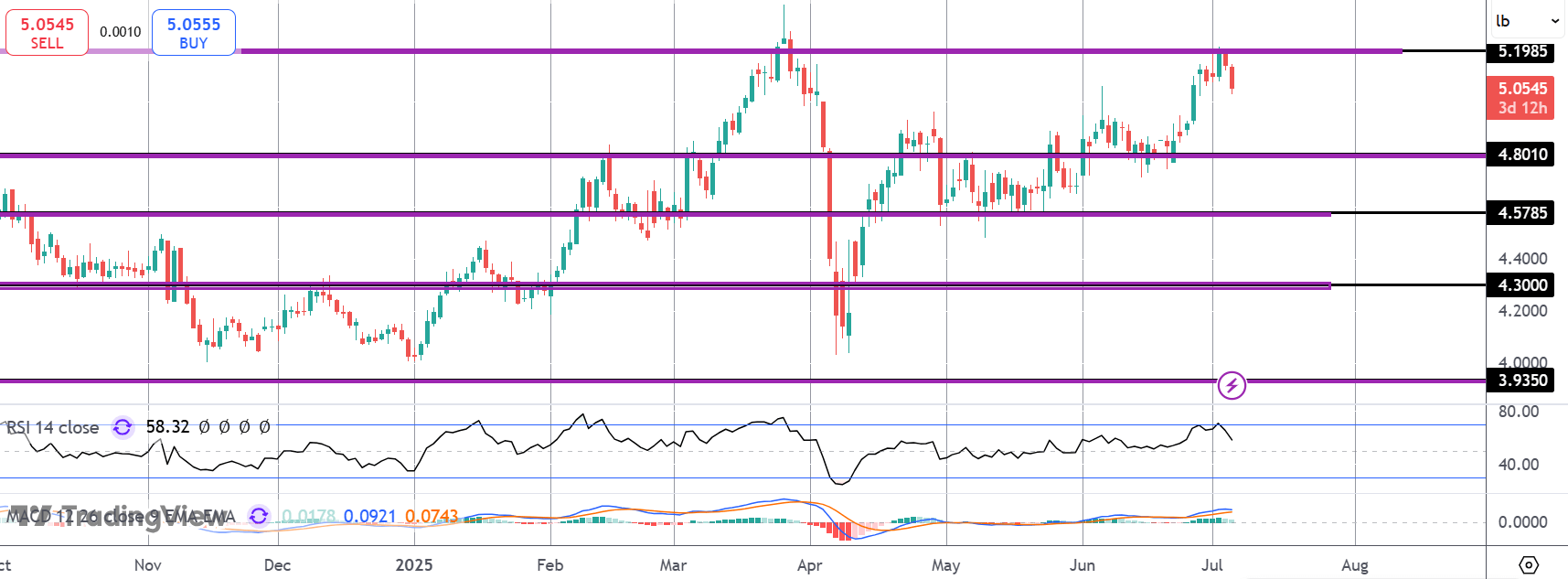

The rally in copper has stalled for now into the 5.1985 level with price now pull back to the 5.05 mark. Falling momentum studies suggest the correction could gather pace near-term with 4.8010 the next support to watch if we do move lower.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.