Carry Trade Flows May Gain Momentum as China Finds Path to Recovery

An upbeat surprise in Chinese economic data for June provided a very limited "quota" for the growing market concerns this week. A pickup in macroindicators across the board, such as industrial production output, consumer spending and investment in fixed assets, should reduce the overall degree of nervousness regarding trade headlines. With negative economic consequences arising from tariffs, China’s ability to take control of the situation somewhat diminishes the importance of a trade war as a risk factor. At least with the current “intensity” of tariff pressure.

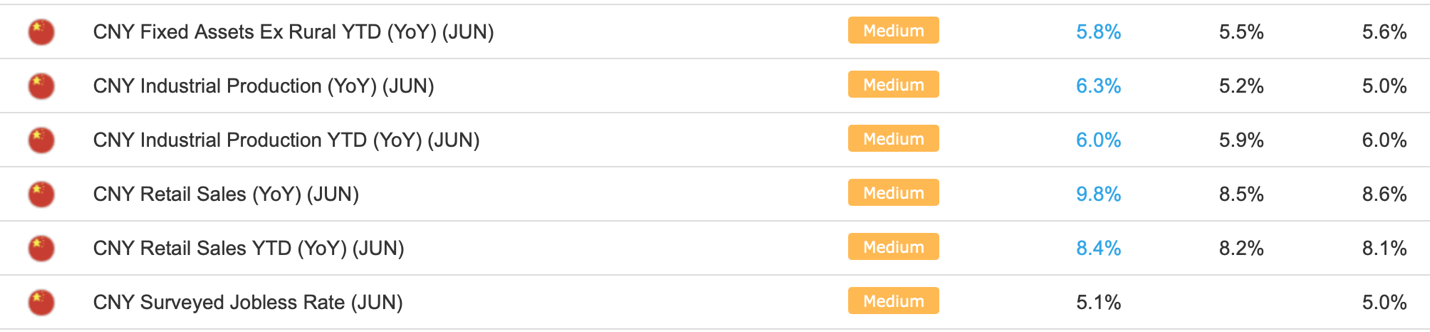

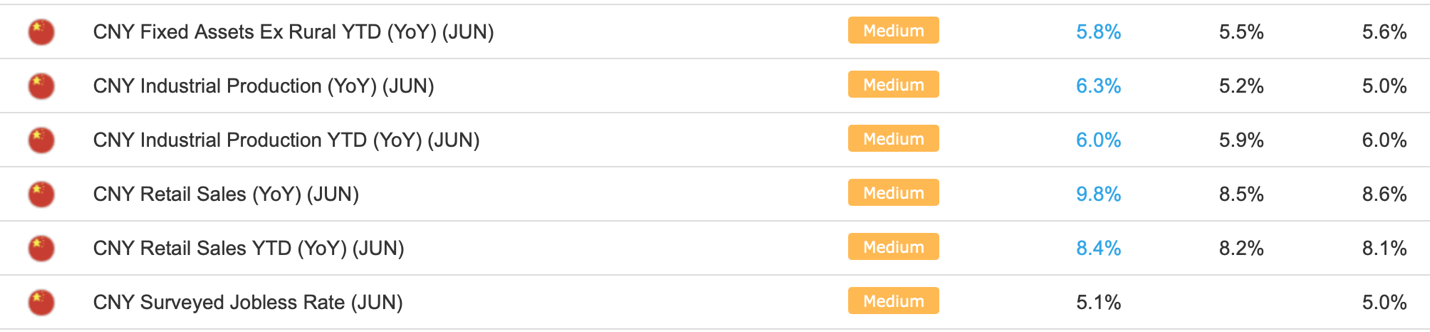

Unemployment among respondents rose to 5.1%, however, the government’s stimulus policy caused a sharp acceleration in retail sales, capital investment and industrial production in June compared with the previous month. Trade figures released on Friday were disappointing as exports and imports declined. Nevertheless, the market expectations for new fiscal stimulus have been somewhat downgraded, as the assumption that Beijing will take the current improvements as the result of recent fiscal measures, which should increase with time.

The Chinese government relied more on fiscal stimulus to support growth in 2019. Tax cuts reached $291 billion, and local governments were allowed an additional bond issue of nearly $300 billion to finance infrastructure projects.

Nevertheless, economic growth may slow to 6% - 6.1% in Q2, testing the lower limit of the target range of the authorities. The PBOC is likely to be proactive with monetary intervention through “classic” RRR cuts for banks here. Since the beginning of 2018, the Central Bank of China has eased this requirement six times, allowing banks to release additional funds to create new loans.

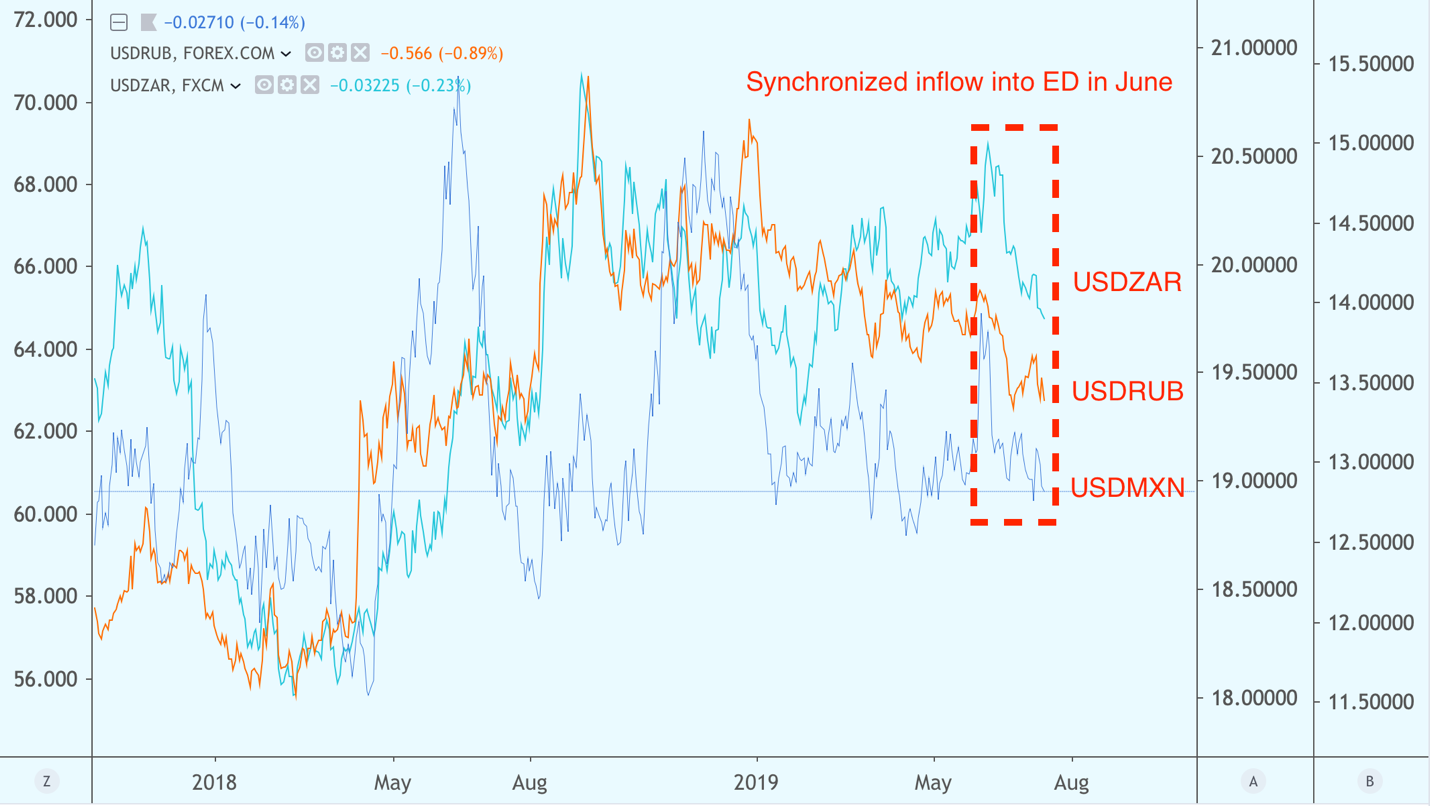

The mix of economic recovery and the expectation of preventive easing of credit conditions in China, decisively sidelines the Chinese economy as an external risk factor to other economies. At least for several weeks. Together with the capitulation of the ECB and the Fed, this shifts the risk/ expected return balance in high-yielding bonds of emerging markets to a more favorable point. This is as the risks associated with the economy decrease and the yield increases due to expectations of lower borrowing costs.

Therefore, the trend to strengthen USDRUB, USDMXN, USDZAR, USDBRL, which began in June, will probably retain the direction in the absence of significant negative headlines, especially about trade confrontations.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.